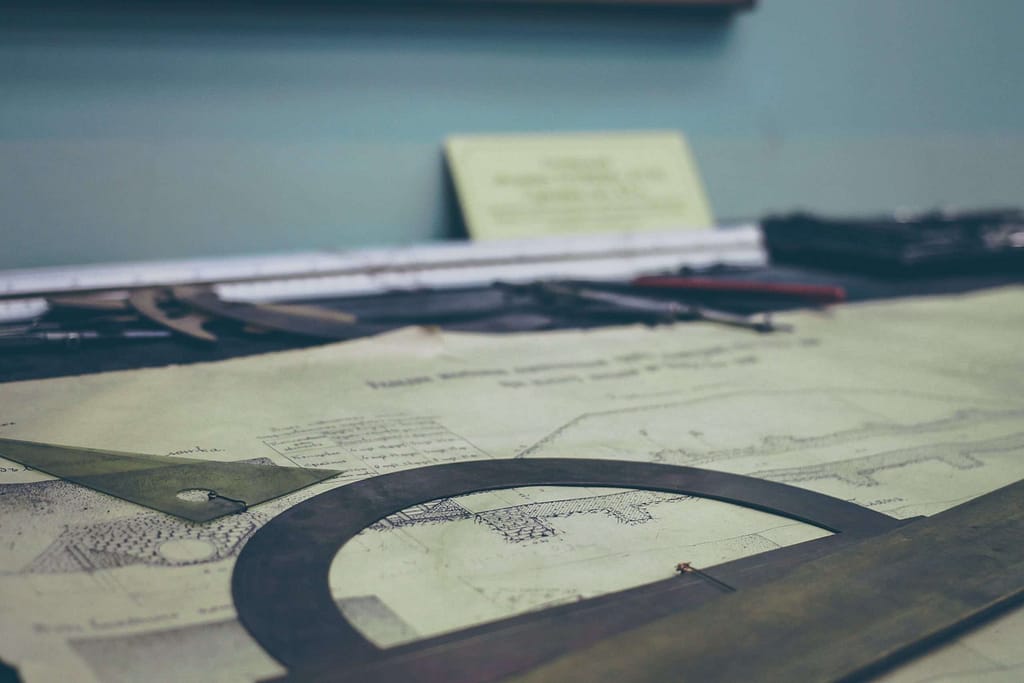

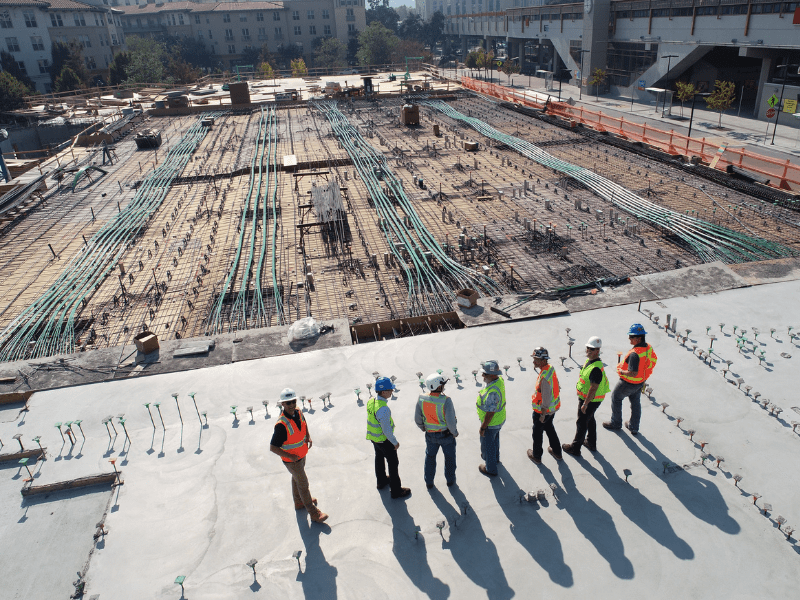

Top Benefits of Broker-Backed CAR Insurance for Thai Developers and Builders

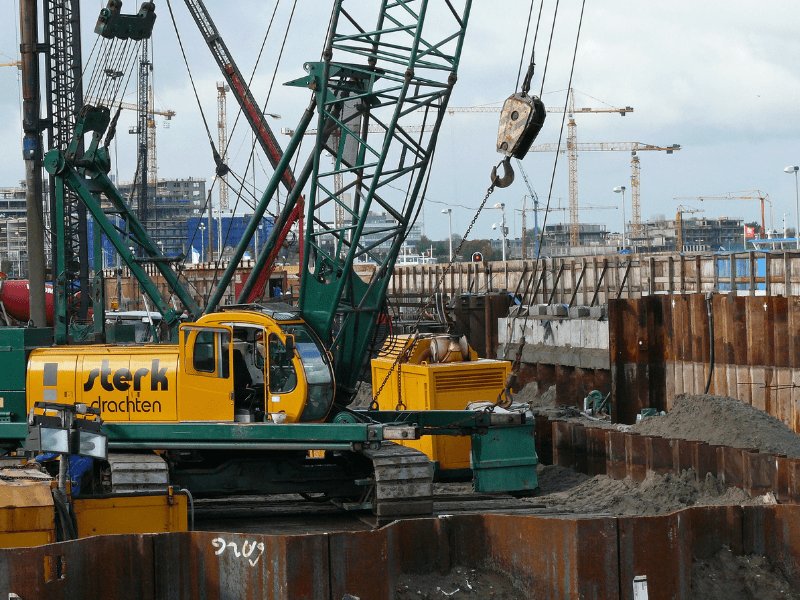

Construction is one of the backbone industries in Thailand, driving economic growth and urban development. From high-rise condominiums in Bangkok to infrastructure projects across